From Overheating to Over-Extraction: Pakistan’s Dollar Dilemma

Based on “Extracting dollars” by Khurram Husain (Dawn, September 4, 2025)

Introduction: A Shift in Economic Paradigm

Economists often warn against overheating—an economy expanding too quickly, triggering inflation and imbalance. Khurram Husain introduces a countervailing concern: over-extraction, where the state attempts to extract resources—especially foreign exchange—at levels the productive economy cannot sustain Dawn.

The Foreign Currency Squeeze: Decoding NFAs

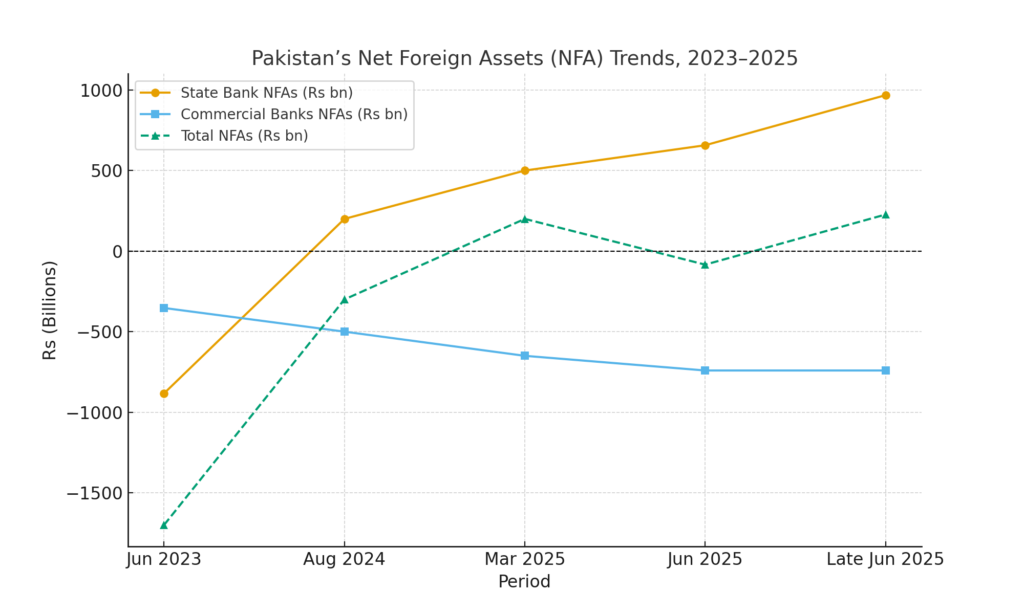

At the heart of Husain’s critique lies the trend in Net Foreign Assets (NFAs) as tracked in the State Bank of Pakistan’s monetary series:

-

Total NFAs have long been negative, indicating that foreign currency liabilities exceeded holdings. From July 2023 (–Rs 1.7 trillion), NFAs only climbed back into positive territory by March 2025 Dawn.

-

This long struggle for stabilization involved rupee depreciation, import restrictions, border controls, and efforts to push remittances through official channels.

Breaking down further:

-

State Bank NFAs turned positive by August 2024, climbing from –Rs 883 billion (June 2023) to nearly Rs 657 billion (June 2025)—a yield of Rs 1.5 trillion Dawn.

-

A temporary drop into negative due to Chinese bond repayment was offset by an equally swift rollover, leading to peaks of Rs 968 billion, and eventually stabilizing around Rs 1.45 trillion Dawn.

-

Simultaneously, commercial banks’ NFAs plunged—from –Rs 353 billion to –Rs 741 billion—signalling that the State Bank has been capturing nearly all incoming foreign exchange flows Dawn.

Key Insight: State Capture of FX Inflows

This data signals a sharp reality: Pakistan’s central bank has effectively monopolized foreign currency inflows, diverting dollars into official reserves while leaving private-sector banks and businesses starved of liquidity. Husain notes that this intensification began around May 2025 Dawn.

Consequences of Centralized Extraction:

-

Escalating exchange rate pressures as private sector access to dollars dwindles.

-

Exporters appear to delay converting earnings, anticipating further devaluation.

-

Persistent interbank vs. informal market premiums, where the black-market ‘hundi’ rate better reflects real demand unless suppressed by state controls.

-

Continued high interest rates, despite inflation cooling—underscored by central bank conservatism amid scarcity Dawn.

Macroeconomic Perspective: From Overheating to Over-Extraction

Husain draws a broader parallel: Pakistan previously battled overheating, which eventually produced a balance-of-payments crisis mid-2022. Now, with over-extraction, growth is stalled, and the economy is being bled dry to sustain the state’s dollar hunger Dawn.

What Lies Ahead: Reform or Rescue

Husain concludes bluntly: Without structural reforms or an external bailout, Pakistan risks entrenching the very instability it seeks to escape Dawn.

Extended Analysis & Figures

a) Timeline of Key FX Indicators

| Period | Total NFAs | State Bank NFAs | Commercial Banks NFAs | Key Event |

|---|---|---|---|---|

| June 2023 | –Rs 1.7 trillion | –Rs 883 billion | – | Start of stabilization effort |

| Aug 2024 | Still negative | Crosses into positive | – | SBP begins reserve buildup |

| March 2025 | Breaks into positive | — | — | Stabilization milestone |

| June 2025 | Positive | Rs 657 billion | –Rs 741 billion | FX flows heavily centralizing |

| Late June 2025 | — | Rs 968 billion** | — | Bond rollover; temporary shift |

**Figures approximated based on Dawn’s reporting Dawn.

b) Impacts and Implications

-

State Control of FX limits liquidity for commerce and industry.

-

Export Caution: Exporters may hold earnings offshore or delay conversion, affecting balance-of-payments.

-

Dual Markets: Interbank vs. black-market spreads create uncertainty, inform real exchange rate expectations.

-

Monetary Rigidity: High interest rates persist to protect reserves, slowing credit and investment.

Conclusion: Steering Through A Crisis

Khurram Husain’s “Extracting dollars” raises a potent alarm: Pakistan’s current economic model leans on extraction rather than growth. Without genuine structural reforms—or externally sourced capital infusion—the economy risks spiraling further into stagnation. The necessity is not just fiscal balance—but equity, sustainability, and revival.